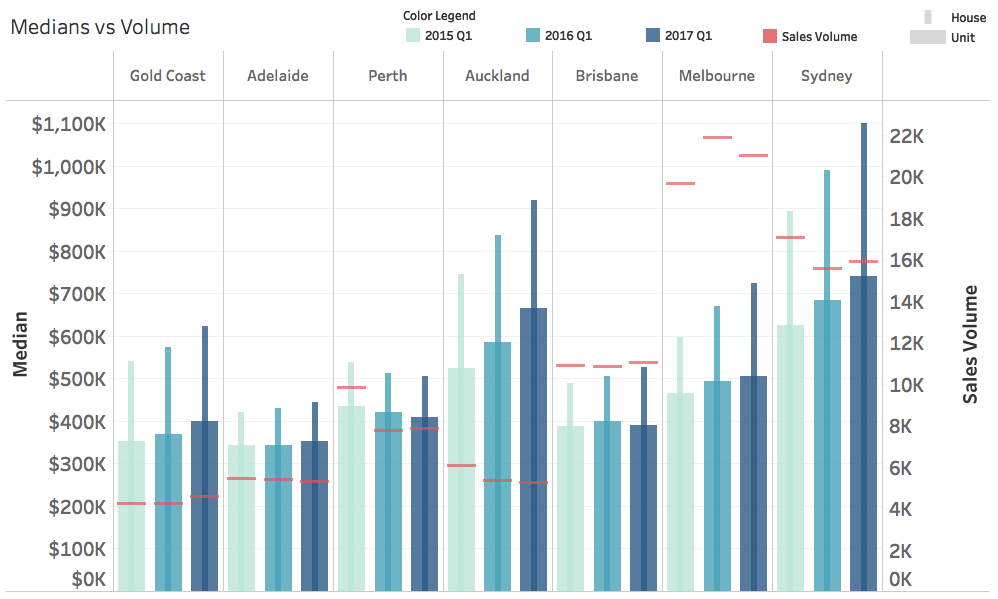

As expected, Sydney remains the standout performer for Q1 2017 with an increase in the median house price in excess of 8%p.a. and growth in sales volume of 2.0%. The gap between Sydney and Melbourne’s median house price has never been so large.

More generally across the nation, the residential house & unit market (new development stock excluded) for Q1 2017 reached $74.5B in value which was a +8.5% increase compared to Q1 2016. Sales volumes increased by +3.9% during this period compared to +0.4% in 2016.

The stand out areas for residential transactions (other than NSW) in Q1 2017 was Qld +5.0%, driven by the Gold & Sunshine Coasts (up from 1.1% in the same quarter in 2016). Surprisingly, VIC volumes eased to +4.5%, down from +12.1% in 2016.

Perth, after some tough periods, is showing signs of improved conditions, with a +1.7% increase in sale transactions for the quarter up from a -17.6% drop in Q1 2016. Similarly, Regional QLD recorded a 14.4% increase up from -4.7% in the previous corresponding period.

New listing stock levels for residential have tightened during the first 6 months of 2017 vs 2016, with a -5.5% decrease recorded across Australia. NSW increased by +3.6%, however, most other states experienced contractions in new stock availability, with QLD -9.7%, VIC -8.3% and WA -4.8%.

The impact of tightening in stock levels coupled with strong demand in key markets are ensuring growth in median house prices across major markets in Australia and New Zealand. The Gold Coast, Melbourne, Sydney and Auckland all recorded increases in the median values of both houses and units of over +8%. Melbourne recorded a +8% increase for median house values but only an increase of +2% for units.

Stay tuned for Q2 results!