Over the years we’ve found the data regurgitated by the press can at times be incongruent with our own. Or at least lacking in context. And our latest in-house data* shows some curious trends.

*Ray White auction data

**Industry data (prior to availability of Ray White auction data)

Observations:

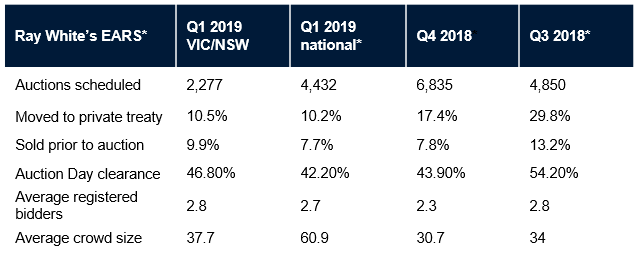

Reflecting on the first quarter of the year, the numbers of registered bidders and the clearance rates remain relatively unchanged quarter to quarter. We’re seeing an increase in auction attendance, as more people attend as curious bystanders, increasing overall crowd numbers, but this increase is not being reflected in numbers of registered bidders. The smaller bidding pools have impacted the likelihood of a sale with a clearance rate of 43 per cent over the quarter. The most relevant shift however is the number of vendors bringing their properties to market. Persistent conversation about decreased values has influenced vendors in their decision to sell with many delaying in hopes of an increase in values across the market.

In the first quarter of 2019 we saw slightly fewer properties taken to auction with over a thousand per month conducted through Ray White in Australia in Q1, down by about 10 per cent on the previous quarter. Yet, our clearance rates decreased only 2 per cent over that time.

It’s a sign that much of the nation’s buyer pool, albeit smaller, remains active in the property market, with the dial barely budging on clearance rates in most states and territories. The more marked downturn in auction volumes is unsurprisingly in Sydney and Melbourne, with approximately half the number of residential homes and units taken to market via auction over the comparable period. Interestingly, our clearance rates have sustained from quarter to quarter.

Our data suggests volume and vendor hesitation has been a real factor influencing this market, but that may be about to change.

Contact Janine Jensen for individual residential property sales transaction trends delivered by Ray White in your market, jjensen@whiteandpartners.com.au

*Ray White represents about 10-15 per cent of all properties brought to market in Australia, and there’s scarcely a market in which we’re not active as agents. Our data sample is collected via the new Express Auction Reporting System (called EARS). Within an hour of every Ray White auction we know the outcome, the crowd size, number of registered bidders, and active bidders. From this we have our own barometre of the market unimpeded by sensation headlines. Our position is that ‘clearance’, for instance, has been a limited definition for success of an auction campaign. In our opinion, accurate analysis of the market and a fair comparison of auction and private treaty must also include those sales prior to auction day, and successful post-negotiations on the same day. As a side note, our data shows on the 30th day of a listing being marketed, the property is five times more likely to sell in an auction campaign as opposed to private treaty. This gap highlights the effectiveness of auction in more challenging markets.