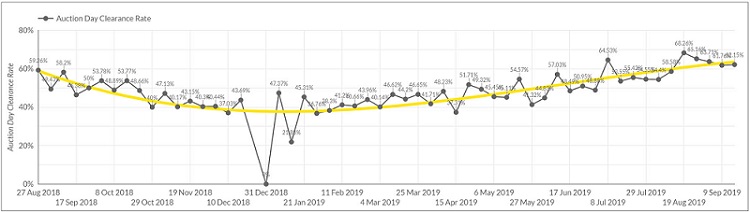

Midyear interest-rate cuts, a reduction in income taxes and moves by banking regulators to ease mortgage-lending rules… how have auctions campaigns responded?

Ray White call’s over 20% of auction in Australia, and our Auction Reporting system gives us up to the day information on sales at a national and local level. If you’d like to know about a particular market, send us an email.

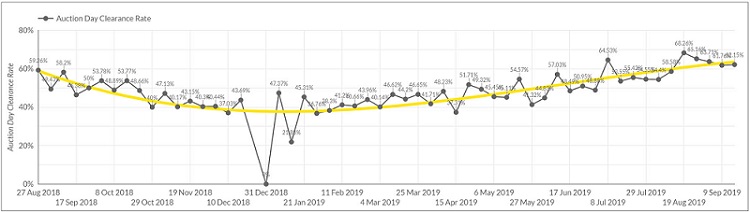

Auction day clearance rates are recovering across the nation to August 2018 levels.

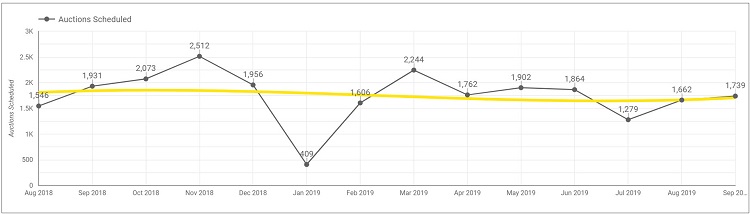

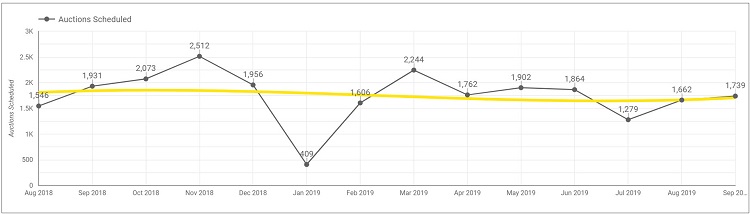

Despite the improved clearance rates, supply of stock remains a struggle. Is this because sellers don’t believe the recovery is truly occurring? Or is it because some buyers still remain in the red and hence are reluctant to sell? Has the decline in interest rates only delayed the inevitable?

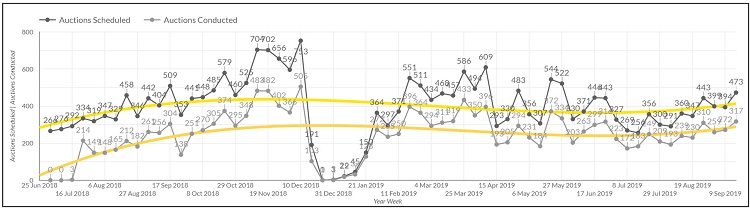

Auctions Scheduled

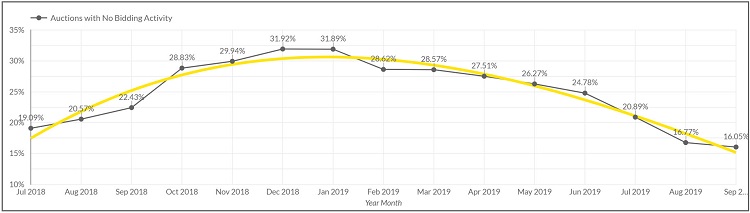

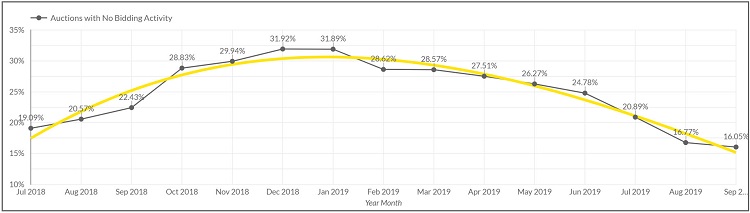

Auctions with no bidding activity are in opposition to season trends; bidding activity has been increasing during winter when it normally slumps; and was weak in summer when bidding activity is conventionally strong.

Auction with no Bidding Activity

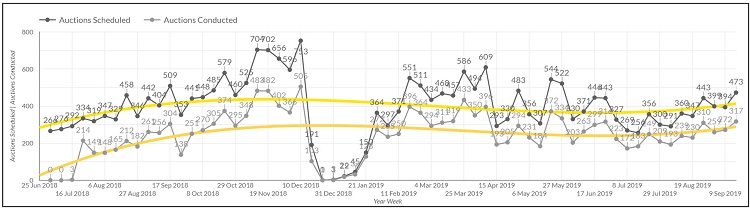

It’s no surprise that as clearance rates improve the numbers withdrawing from auction declines. See the gap between the blue and red lines: the thinner the gap the better, its shows us that sellers are meeting the market.

Auctions Scheduled vs Auctions Conducted

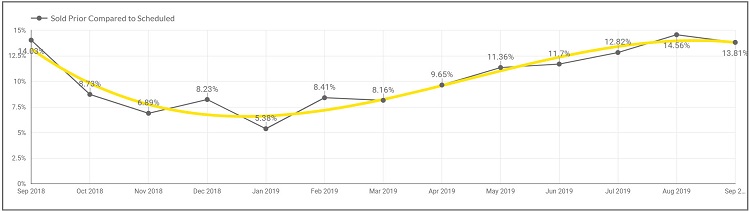

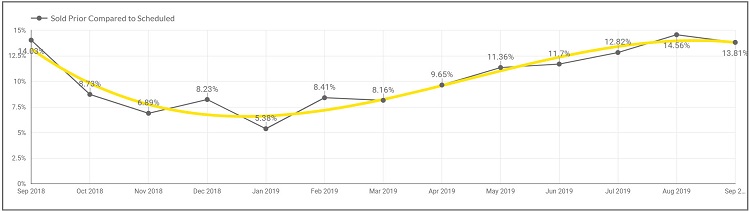

Okay, so this is an interesting one. Generally when things improve, sellers tend to go to auction because they have confidence. But this graph shows us something different. More sellers are selling before auction, yet clearance rates are improving…this is not the norm.

Sold Prior: Compared to Scheduled

Ultimately while we see things improving, our statistics are showing that some sellers just don’t believe in the recovery. As we head into our prime spring season, it will be curious to see what the data spits out. Stay tuned.

The headlines tell a calamitous story. “Australia’s $133 billion property price slide rapidly becoming the worst in modern history,” the ABC wrote. “Aussie property prices endure 17th straight month of falls,” Nine reported. “…Auction clearance rates remain depressed,” The Australian printed recently.

Over the years we’ve found the data regurgitated by the press can at times be incongruent with our own. Or at least lacking in context. And our latest in-house data* shows some curious trends.

*Ray White auction data

**Industry data (prior to availability of Ray White auction data)

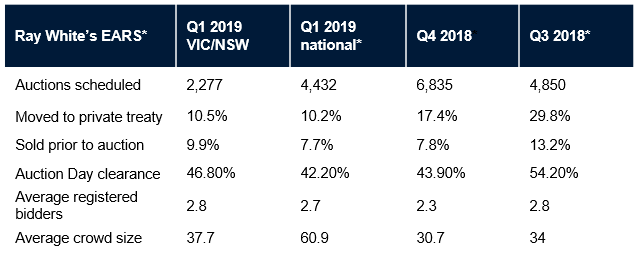

Observations:

- The busiest selling season is traditionally spring but it has been outperformed by summer where the volume of listings grew.

- Auction clearance rates are well below the peaks of 2016/17 – where Melbourne and Sydney peaked at ~80%. However these rates are still well above the GFC levels of ~30%.

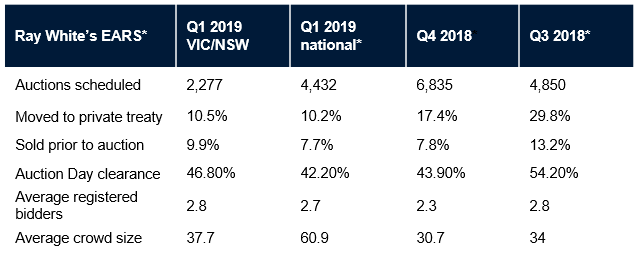

- The percentage of vendors withdrawing from auction has declined from 30% to 10% over a 9 month period, reflecting that vendors are more willing to go to auction to identify the market value of their homes. Clearly the declining clearance rates highlights a continued discrepancy between buyers and sellers.

- Curiously, the number of registered bidders has remained constant, however auction-day crowds have nearly doubled from late last year to this year. Are we witnessing a renewed interest from buyers linked to declining price?

Reflecting on the first quarter of the year, the numbers of registered bidders and the clearance rates remain relatively unchanged quarter to quarter. We’re seeing an increase in auction attendance, as more people attend as curious bystanders, increasing overall crowd numbers, but this increase is not being reflected in numbers of registered bidders. The smaller bidding pools have impacted the likelihood of a sale with a clearance rate of 43 per cent over the quarter. The most relevant shift however is the number of vendors bringing their properties to market. Persistent conversation about decreased values has influenced vendors in their decision to sell with many delaying in hopes of an increase in values across the market.

In the first quarter of 2019 we saw slightly fewer properties taken to auction with over a thousand per month conducted through Ray White in Australia in Q1, down by about 10 per cent on the previous quarter. Yet, our clearance rates decreased only 2 per cent over that time.

It’s a sign that much of the nation’s buyer pool, albeit smaller, remains active in the property market, with the dial barely budging on clearance rates in most states and territories. The more marked downturn in auction volumes is unsurprisingly in Sydney and Melbourne, with approximately half the number of residential homes and units taken to market via auction over the comparable period. Interestingly, our clearance rates have sustained from quarter to quarter.

Our data suggests volume and vendor hesitation has been a real factor influencing this market, but that may be about to change.

Contact Janine Jensen for individual residential property sales transaction trends delivered by Ray White in your market, jjensen@whiteandpartners.com.au

*Ray White represents about 10-15 per cent of all properties brought to market in Australia, and there’s scarcely a market in which we’re not active as agents. Our data sample is collected via the new Express Auction Reporting System (called EARS). Within an hour of every Ray White auction we know the outcome, the crowd size, number of registered bidders, and active bidders. From this we have our own barometre of the market unimpeded by sensation headlines. Our position is that ‘clearance’, for instance, has been a limited definition for success of an auction campaign. In our opinion, accurate analysis of the market and a fair comparison of auction and private treaty must also include those sales prior to auction day, and successful post-negotiations on the same day. As a side note, our data shows on the 30th day of a listing being marketed, the property is five times more likely to sell in an auction campaign as opposed to private treaty. This gap highlights the effectiveness of auction in more challenging markets.

Rural Australia is welcoming this reprieve as the green shoots start to appear but the longer term impact of the recent rain on the agricultural landscape is yet to be seen.

It’s been a long winter but right now the cracked lands in parts of Queensland and northern New South Wales are drinking in some overdue welcome rain to break the dry spell. According to data by the Australian Bureau of Meteorology, parts of Queensland and New South Wales received the lowest rainfall on record in the last four months.

Rural Australia is welcoming this reprieve as the green shoots start to appear but the longer term impact of the recent rain on the agricultural landscape is yet to be seen.

One thing is clear though, it is better than no rain at all. What we do know is this: the impact an extended dry period is having on the overall state of the property, grain and livestock markets is real and deep.

Nervousness leads to hesitation and caution leads to inertia where people sit on their hands. This is turn leads to a downward trend in pricing for rural markets as sentiment shifts. For example, in cattle sale yards across New South Wales, it is not uncommon to see grown steers trading for $2.45/kg (October 2017). One year ago, grown steers were trading for $3.60/kg.

Across Australia, significant property assets are being offered to the market across multiple agricultural fields. It is unclear whether these offerings are because institutions have not realised anticipated returns, a consequence of dry times or just the expected return on investment is not good enough.

On the plus side, the Australian dollar weakness against the US Dollar is providing protection currently against easing prices in the wool market in recent weeks and as a result the price has remained firm. Interestingly, whilst there has been a fall in almost all aspects of the cattle market in recent weeks, lamb prices have remained strong, defying a dry time trend. In October 2017, 24kg lambs were selling at $5.85/kg, compared with $5.60/kg one year ago.

In recent years, there have been record levels of investment into the agricultural sector. For many of the new owners, the recent dry period will represent their first test of resolve. With this as the background, we believe now is a good time to take a closer look at emerging opportunities in the protein and water rights space.

White and Partners had the pleasure of hosting some of our key partners at our annual White and Partners Leadership Academy. The event was hosted by Professor Boris Groysberg, a tenured professor of business administration at the prestigious Harvard Business School.

White and Partners had the pleasure of hosting some of our key partners at our annual White and Partners Leadership Academy. The event was hosted by Professor Boris Groysberg, a tenured professor of business administration at the prestigious Harvard Business School. Attendees included:

- House of Hiranandani, a key strategic partner and one of India’s largest developers who travelled from Mumbai to attend;

- Duffy Kennedy Constructions, a builder and our partner at the mixed use project – Union Place, Jannali;

- Monarch Hotels, our partner at the Acacia Ridge Hotel;

- Colosimo Family, one of Sydney’s most well-known publican families led by Marcello Colosimo

- Commonwealth Bank of Australia, the primary debt funder within our Hotel portfolio; and

- Weinstock family, a key supporter of the White & Partners’ business for over 10 years

The day involved the study and discussion of two famed Harvard business case studies, including Wolfgang Keller and Jack Welsh. As expected the Wolfgang Keller discussion resulted in a number of camps, fire Keller or restructure the business to suit his strengths. The quality of discussions was outstanding, with participants sharing their responses to similar situations faced within their own organisations. For most in the room, it also raised important questions such as:

- How do we handle an employee that is not performing?

- When is firing a star employee the right decision in a market where skills are hard to find?

- Is the problem the employee or the manager?

- Are we as manager extracting the best from our employees?

- Are we setting the right examples and giving enough ownership to those reporting to us?

The diversity of participants contributed to the success of the event. We were pleasantly surprised to receive feedback that despite operating in different industries, all participants have faced similar challenges in managing star employees and increasing staff productivity growth through organisational restructuring. Participants also unanimously agreed, that hiring stars is one thing, hiring them in the right role is another!

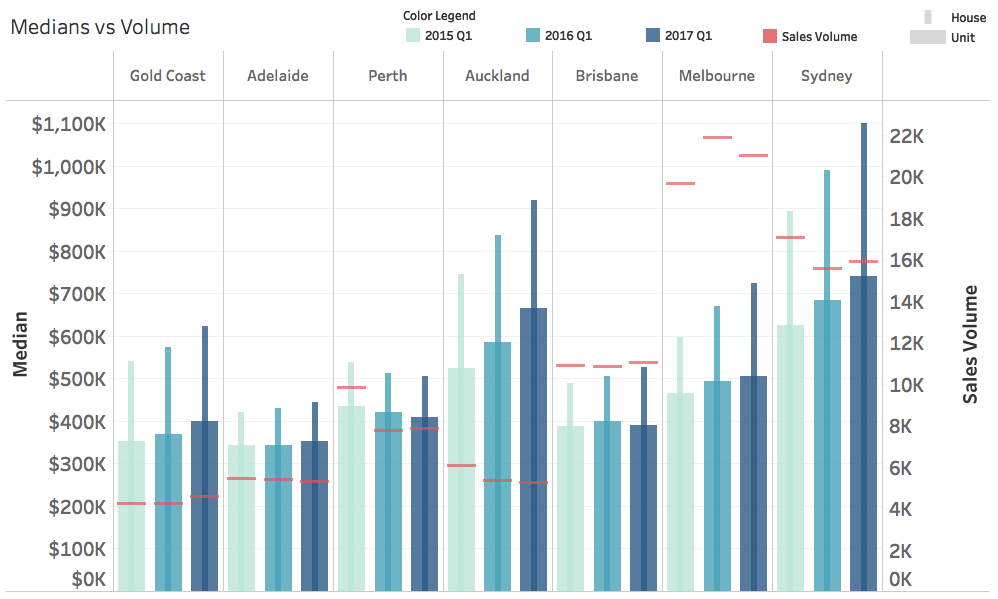

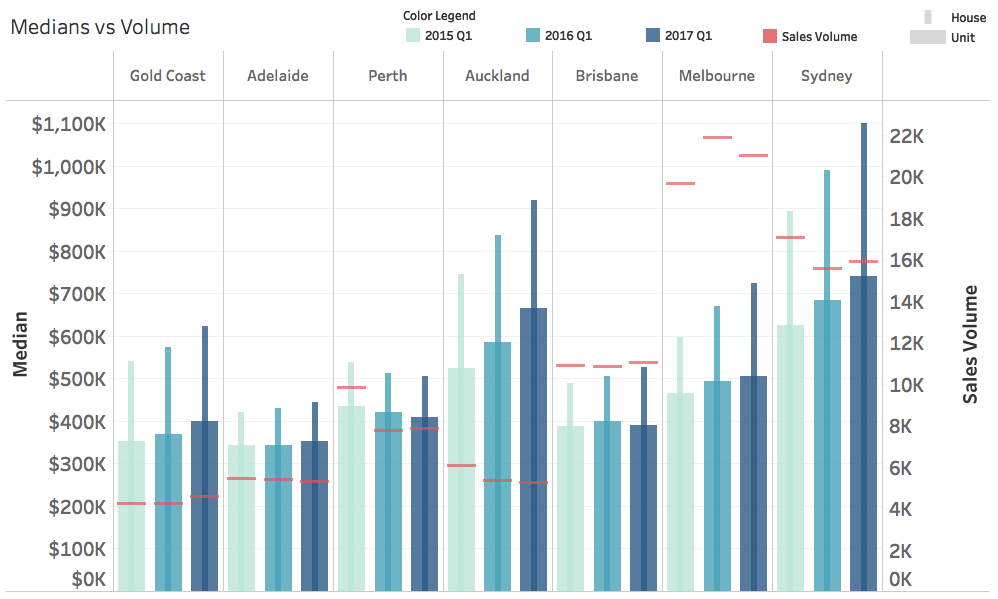

As expected, Sydney remains the standout performer for Q1 2017 with an increase in the median house price in excess of 8%p.a. and growth in sales volume of 2.0%. The gap between Sydney and Melbourne’s median house price has never been so large.

As expected, Sydney remains the standout performer for Q1 2017 with an increase in the median house price in excess of 8%p.a. and growth in sales volume of 2.0%. The gap between Sydney and Melbourne’s median house price has never been so large.

More generally across the nation, the residential house & unit market (new development stock excluded) for Q1 2017 reached $74.5B in value which was a +8.5% increase compared to Q1 2016. Sales volumes increased by +3.9% during this period compared to +0.4% in 2016.

The stand out areas for residential transactions (other than NSW) in Q1 2017 was Qld +5.0%, driven by the Gold & Sunshine Coasts (up from 1.1% in the same quarter in 2016). Surprisingly, VIC volumes eased to +4.5%, down from +12.1% in 2016.

Perth, after some tough periods, is showing signs of improved conditions, with a +1.7% increase in sale transactions for the quarter up from a -17.6% drop in Q1 2016. Similarly, Regional QLD recorded a 14.4% increase up from -4.7% in the previous corresponding period.

New listing stock levels for residential have tightened during the first 6 months of 2017 vs 2016, with a -5.5% decrease recorded across Australia. NSW increased by +3.6%, however, most other states experienced contractions in new stock availability, with QLD -9.7%, VIC -8.3% and WA -4.8%.

The impact of tightening in stock levels coupled with strong demand in key markets are ensuring growth in median house prices across major markets in Australia and New Zealand. The Gold Coast, Melbourne, Sydney and Auckland all recorded increases in the median values of both houses and units of over +8%. Melbourne recorded a +8% increase for median house values but only an increase of +2% for units.

Stay tuned for Q2 results!

The National office markets have shown some mixed results, Sydney and Melbourne have been the outstanding performers while Brisbane looks to be on the up and Perth continues in the doldrums.

The National office markets have shown some mixed results, Sydney and Melbourne have been the outstanding performers while Brisbane looks to be on the up and Perth continues in the doldrums.

Suburban markets have shown some good results with Parramatta featuring one of the lowest vacancy rates at just 4.3% and regional markets like Newcastle and Sunshine Coast have shown some improvement which has done much to stimulate the local economy.

Listen to our Head of Research Vanessa Rader elaborate further in the above video

To view the latest Between the Lines research publications which features Ray White Commercial’s recent analysis on the markets, please visit our website at: https://www.raywhitecommercial.com/research/

Brian White has told the story privately several times, but never to the world. Despite being in the business for over 50 years Brian had not done a sit down media interview until recently.

Brian White has told the story privately several times, but never to the world. Despite being in the business for over 50 years Brian had not done a sit down media interview until recently, when he met with The Australian to tell the story of his family heritage.

More than 100 years ago, in the small Queensland country town of Crows Nest in the heart of the Darling Downs, Ray White established a real estate firm that would go on to become Australia’s largest residential agency, with over 1,000 offices around the world across New Zealand, Singapore, Hong Kong, Shanghai, Indonesia and India, Middle East as well as Australia.

But among the success, the White family has certainly never forgotten its roots. Each of Brian White’s sons has pivotal roles in the business. Since 2001, Dan White has led the family’s business specialist investment and advisory firm now called White & Partners.

Last month Ray White attended the invite-only World Economic Forum event in Davos, Switzerland, which included 150 of the most influential international family business leaders. Ray White was the inaugural winner for the most effective real estate brand campaign of 2016. Adding to the infinite achievements of 2016 Ray White also made the accounting firm’s list of the top 50 family business in the world. It was the only Australian firm to make the cut.

The Ray White Group saw property sales amount to $44 billion in 2016, a 10 per cent increase over the previous year. Very few multibillion-dollar family companies in Australia have successfully extended to the fourth generation, making Ray White unique in business traditions.

At White & Partners our approach is based on the same family values. We believe in investing in great people doing great things in the property industry.

Click here to read The Australian article

In December 2016, The Tennyson Hotel was sold to the Merivale Group for $37.05 million, equivalent to an 8.25% yield. The sale was the highest price secured in a public hotel auction.

In December 2016, The Tennyson Hotel was sold to the Merivale Group for $37.05 million, equivalent to an 8.25% yield. The sale was the highest price secured in a public hotel auction. In partnership with JDA Hotels, White & Partners acquired the Tennyson Hotel in Mascot for $25 million in 2015. The sale price represents an increase in value of 48% in 18 months.

The contributing factors to the resounding success of the sale were the strong underlying fundamentals of the asset and favourable market conditions. To a prospective purchaser, the Tennyson Hotel offered:

- Reliable and stable revenue, primarily from gaming, leading to consistent bottom line income;

- Prime location – as a suburb, Mascot is an area experiencing major gentrification which will further benefit the hotel into the future; and

- Refurbishment upside – sold with DA approval, the hotel was in need of a major renovation.

Hotel yields are typically last to follow the trends of core markets. The sale of the Tennyson Hotel at 8.25%, in conjunction with the recent sales of the Lantern portfolio, cements yields for Sydney gaming pubs at pre GFC levels.

For investors in the syndicate, the returns realised in 18 months (IRR of approximately 55%p.a.) where originally planned over 5 years. A great example of how in a strong investment environment, prime assets can achieve results well beyond expectations.

The vacancy rate across the Sydney CBD market dropped to 5.6 per cent in the 6 months to July 2016 down from 6.3 per cent in January. This is due to development activity in buildings.

The vacancy rate across the Sydney CBD market dropped to 5.6 per cent in the 6 months to July 2016 down from 6.3 per cent in January. This is due to development activity in buildings such as 1 Alfred Street, which has required over 130 tenants to vacate as the building owner (Wanda Group) seek to redevelop the site commencing 2017.

In addition, the compulsory acquisition of 55 Hunter, 5 Elizabeth, 39 Martin Place and 175 Castlereagh Street for the Sydney Metro train stations is forcing more tenants into the market. Also the highly anticipated Brookfield development site at 301 George Street, and 71 Macquarie Street owned by Macrolink Australia who are looking to convert to residential.

This unprecedented supply withdrawal and resultant demand has continued the upward pricing pressure on the A and B grade office market.

At 28 OConnell Street Ray White Commercial agents Jeremy Piggin and Elizabeth Braithwaite have secured office rents of $985sqm to $995sqm gross for the new owners Coombes Property Group who purchased the building from Chubb for $94 Million in November 2016. Mr Piggin struck a whole floor 484sqm deal with Jobadder at a rent of $985sqm. This is a significant increase in rental by comparison to $760sqm gross achieved in the building in 2015.

At 4 Martin Place Ray White Commercial Agents Anthony Harris and Jeremy Piggin have assisted a financial services firm sub lease a 226sqm suite at a rental of $820sqm gross, a significant rent increase from $575sqm gross effective being paid under the head lease. The incoming subtenant, E5 Workflow, is currently occupying space at 1 Alfred Street and is one of many tenants needing to relocate by December 2016.

At 50 Margaret Street Anthony Harris and Jeremy Piggin have secured 6 lease transactions totalling over 2,500sqm for Singaporean owners Rockworth Capital, with rents of up to $950sqm gross being achieved. Of the transactions in the last few months two were whole floor deals of approximately 700sqm each. Bridges Lawyers secured Level 2 at $765sqm, also coming out of 1 Alfred Street. And Aconex secured Level 7 at $825sqm. Aconex are exiting 181 Miller Street, North Sydney which is a government acquired building for the Sydney Metro Rail.

Future Sydney CBD Office Supply:

- 140,191sqm of new stock is due to enter the market in the second half of 2016

- 24,986sqm is due to be completed in 2017

- 66,000sqm is due to come online from 2018 onwards

- A total of 84,000sqm of space is mooted

Marketed by Ray White Projects, The Miller in North Sydney offers 23 levels of luxury residential living. Located at the door step of the upcoming Victoria Cross Metro-line Station, the project is a significant milestone for the evolving suburb.

Marketed by Ray White Projects, The Miller in North Sydney offers 23 levels of luxury residential living. Located at the doorstep of the upcoming Victoria Cross Metro-line Station, the project is a significant milestone for the evolving suburb.

Designed by internationally renowned architects PTW and developed by The Yuhu Group, The Miller offers a new concept for city fringe living with a unique user pay concierge and leisure services available to all residents.

The success of this project has been underpinned by a targeted marketing campaign that achieved a stage 1 sell out at launch with record pricing. The second release was met with great demand and was sold out ahead of the developer’s expectations and the projects final stage is now selling.

Richard Crookes Construction has been appointed to build the development with demolition underway. With a gross realisation above $220 million this is a significant project for the Ray White Projects team.